Decision engines in production

Decision engines that lift the bottom line

For private equity operators and mid market enterprises that demand measurable EBITDA, margin, and cash outcomes within weeks.

Outcome bands

Outcome ranges tied to deployed decisions

Ranges reflect current delivery experience and internal benchmarks.

Inventory policy and service level optimization.

Price, mix, and discount governance.

Decision engines embedded in execution workflows.

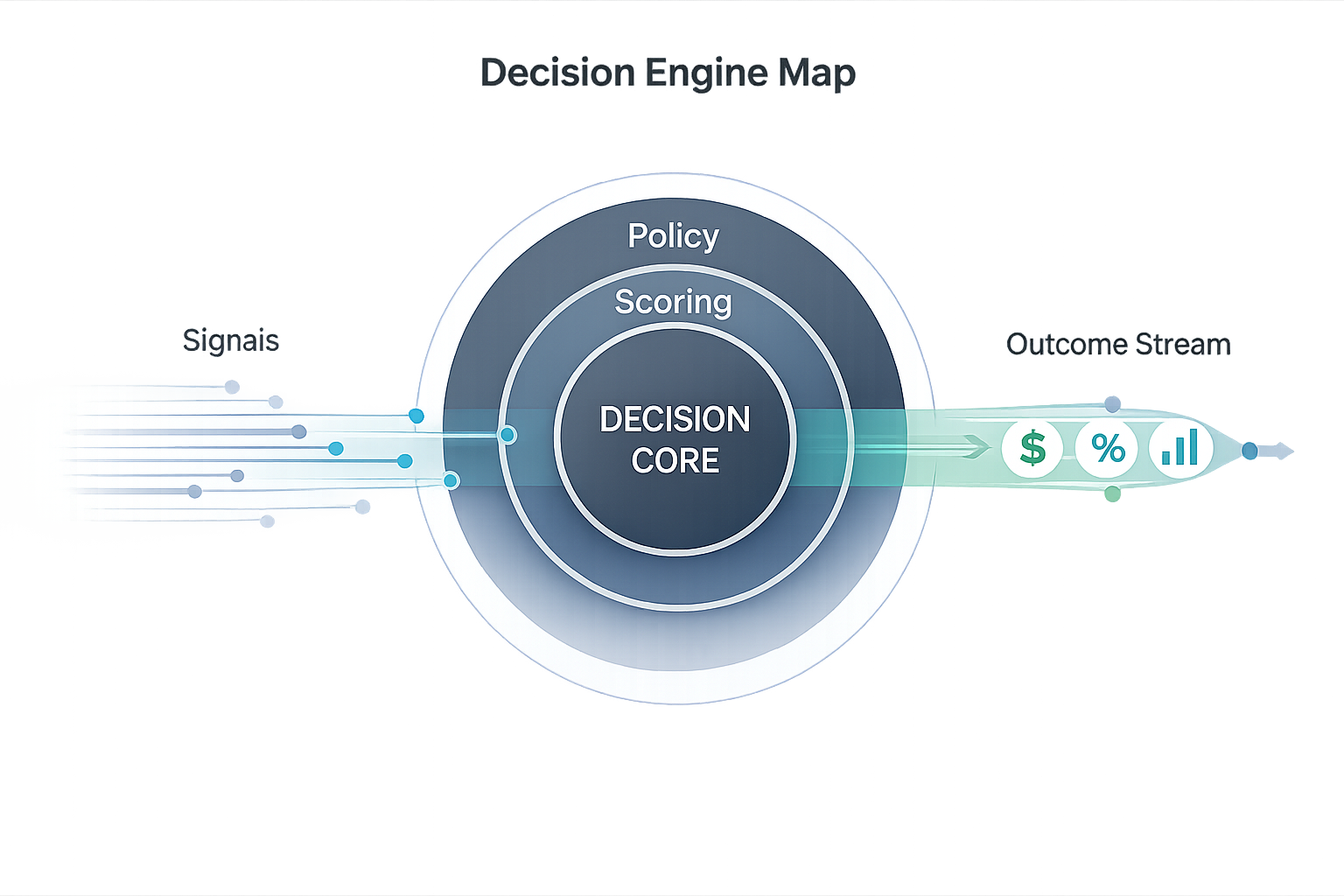

Decision engine map

Signals become decisions and outcomes

Fable integrates signals, constraints, and targets into production decision flow with monitoring.

Market gap

Analysis is not deployment

We close the gap between analytic insight and executed decisions inside workflows.

Models without decision flow

Insight exists, but decisions are not governed or deployed at scale.

Decisions inside workflow

Policy is executed with monitoring and measured outcomes.

Engagement path

Briefing then QOA

After a private briefing, the QOA confirms value, data feasibility, and delivery gates across 2-3 weeks.

Delivery gates can be reached in as little as eight to fourteen weeks for focused scopes, with longer implementations running six months or more.

Value hypothesis

Decision owner alignment with an economic model tied to EBITDA and cash.

Data feasibility

Source mapping, access plan, and constraint review with governance.

Delivery gate

Architecture, security posture, and deployment plan with clear milestones.

Value hypothesis, data feasibility, and delivery plan.

Prototype tied to a decision owner and real data.

Integration, governance, and deployment.

Engine atlas

Engines mapped to EBITDA levers

Each engine aligns to a decision owner, levers, and measurable outcomes.

Revenue Engine

Pricing and commercial decisions that protect margin and win rate.

Set price corridors with demand and capacity signals.

Efficiency Engine

Operational decisions that release working capital and stabilize service.

Balance inventory policy and service targets under volatility.

Strategic Engine

Capital allocation decisions with downside protection and hurdle rate confidence.

Compare portfolio scenarios under volatility and capital constraints.

Capability Engine

Model reliability and governance that protect value in production.

Reduce drift exposure and restore accuracy with automation.

Proof signals

Evidence through value gates

Validation is structured before any pilot and confirmed in production.

Value hypothesis signed by decision owner

Outcome metrics, constraints, and data boundaries documented.

ROI model with sensitivity bands

Assumptions transparent and reviewed with finance leadership.

Deployment gates and monitoring

QOA, pilot, and implementation with explicit value gates.

Private briefings

Private briefings by pillar

Briefings map inputs to EBITDA impact before a QOA and are shared on request.

Procurement readiness

Security and governance by default

Dedicated environments, audit trails, and documented controls are standard.

Start with a private briefing

Briefings align decision owners, value hypotheses, and data access. The QOA follows for quantified feasibility and delivery gates. If the QOA cannot quantify measurable upside, you do not pay for the QOA.